- First Step to Final Offer

- Posts

- First Step to Final Offer 9/30/25

First Step to Final Offer 9/30/25

Your weekly round-up of an M&A deal walkthrough, insightful market news summaries, technical quiz questions, and various internships, events, and diversity programs. A key resource to best prepare yourself for finance recruiting. If someone sent you the newsletter subscribe below!

CAREER OPPORTUNITIES

RecruitU Partner Opportunities

RecruitU partners are companies that have recruiters actively using RecruitU to find students for their full-time and internship roles. So if you’re signed up, you have direct visibility with these companies.

Class of 2026 Finance and Consulting Opportunities

Barclays Finance Analyst Graduate Program 2026 New York City Link

CIBC 2026 Analyst I, Corporate Banking Link

Jefferies 2026 Investment Banking Analyst - Houston, Energy Transition Group Link

Jefferies 2026 Investment Banking Analyst – Charlotte, Aerospace, Defense & Government Group Link

BMO Capital Markets Commercial Analyst Development Program - Multiple Roles and Locations Link

JPMorgan Chase & Co 2026 Commercial & Specialized Industries Full-time Analyst Program – Asset-Based Lending Link

L.E.K. Consulting U.S. Consultant - 2026 Link

Mizuho Bank Ltd Investment & Corporate Banking - Latin America Finance - Portfolio Management, Analyst Link

Morgan Stanley 2026 Investment Management Spring Co-Op Program - Multiple Roles and Locations Link

Truist 2026 Wholesale Credit Delivery - Corporate & Leveraged Finance - Analyst Program Link

Nomura Securities International 2026 Investment Banking Full-Time Analyst Program - San Francisco Link

Piper Sandler Equity Research Intern – Financial Services Group Link

Piper Sandler Public Finance Investment Banking Analyst Link

UBS 2026 Graduate Talent Program - Group Internal Consulting Link

CIBC 2026 Analyst I, Global Investment Banking - US Middle Markets Link

Marsh McLennan Government Health Consulting - College Program 2026 - Multiple Roles and Locations Link

Class of 2027 Finance Opportunities

KeyBank 2026 Wealth Management Internship - Multiple Roles and Locations Link

Bank of New York Mellon (BNY Mellon) 2026 BNY Summer Internship Program - Multiple Roles and Locations Link

Wells Fargo 2026 Summer Internship, Early Careers – CIB Commercial Real Estate - Multiple Roles and Locations Link

The Carlyle Group 2026 Global Investor Relations Sales Intern Link

StepStone Group 2026 StepStone Private Wealth Summer Analyst Link

Point72 2026 Summer Internship - Finance Link

Morgan Stanley 2026 Investment Management Summer Analyst Program - Global Risk and Analysis (New York) Link

Moelis & Company 2026 Summer Analyst, Investment Banking - Capital Markets Group Link

UBS 2026 Summer Internship - Wealth Management - Jersey Link

Baird Internship Summer 2026 - Multiple Roles and Locations Link

BMO Capital Markets Commercial Banking Credit Analyst Internship, Summer 2026 - Multiple Roles and Locations Link

Blackstone 2026 Blackstone Finance Summer Analyst - Multiple Roles and Locations Link

CIBC 2026 Summer Intern - Multiple Roles and Locations Link

TD Cowen 2026 Summer Internship Program - Multiple Roles and Locations Link

KeyBank Summer 2026 Commercial Bank Internship - Multiple Roles and Locations Link

KeyBank Summer 2026 Real Estate Capital Internship - Multiple Roles and Locations Link

KeyBank Summer 2026 Key Investment Services Internship (Certified Financial Planner Track) - Multiple Roles and Locations Link

Santander Bank, N.A. 2026 Summer Internship Program - Multiple Roles and Locations Link

Capstone Summer 2026 Internship - Multiple Roles and Locations Link

Standard Chartered Bank Internship Programme US 2026 - Multiple Roles and Locations Link

Loop Capital Markets, LLC Municipal Sales Intern – Fixed Income Division Link

Stephens, Inc. Private Wealth Management Intern (Summer 2026) Link

PIMCO 2026 Summer Intern – Trading Analyst, US Link

Jefferies 2026 Corporate Services Summer Analyst Program – New York Link

Brevan Howard US Investment Management LP 2026 Summer Internship Program - Multiple Roles and Locations Link

Class of 2027 Consulting Opportunities

To see c/o 2027 opportunities, click here: Class of 2027 Application Tracker

Class of 2028 Finance Opportunities

TECHNICAL QUESTION OF THE WEEK:

Your company sells equipment for $85, though it was listed at $100 on the Balance Sheet. You record a $15 Loss on the Income Statement, which is reversed on the Cash Flow Statement. Why is this Loss a non-cash expense? |

|

MARKET NEWS

Goldman and JPMorgan Lead Record $55B LBO of Electronic Arts

Goldman Sachs and JPMorgan have landed advisory and financing roles on the largest leveraged buyout ever—Electronic Arts’ $55 billion sale to a Silver Lake-led consortium. Goldman is advising EA, while JPMorgan is backing the deal with $20 billion in debt financing and supporting Silver Lake. The transaction cements Goldman’s No. 1 spot in global M&A rankings and brings JPMorgan closer to rival Morgan Stanley. With backing from Saudi Arabia’s PIF and Jared Kushner’s Affinity Partners, the deal highlights a growing trend: bulge-bracket banks dominating megadeals as boutique firms are sidelined.

Source: Bloomberg

Hedge Funds Stage Biggest Selloff in Asian EM Stocks Since April

Global hedge funds offloaded the most emerging Asia equities in over five months during the week of September 19–25, according to a Goldman Sachs client note seen by Reuters. The selloff, concentrated in Chinese, Indian, and Taiwanese stocks, was largely driven by profit-taking—especially in tech names—as investors trimmed risk ahead of the region’s extended holiday season. The MSCI EM Asia Index fell 1.6% that week, snapping a three-week rally, while Chinese onshore investors also rushed to reduce leverage, marking the largest daily margin trimming since April. Despite the pullback, EM Asia stocks have outpaced global peers in 2025, boosted by optimism around U.S. rate cuts and China’s AI boom

Source: Reuters

M&A DEAL OVERVIEW

Silver Lake, Affinity Partners, and Saudi Arabia’s Public Investment Fund (PIF) Lead Record $55B Buyout to Take Electronic Arts Private

Electronic Arts has agreed to a $55 billion sale to a consortium led by Saudi Arabia’s Public Investment Fund (PIF), Silver Lake, and Jared Kushner’s Affinity Partners—marking the largest leveraged buyout in history. The deal includes $36 billion in cash and equity from PIF and $20 billion in debt arranged by JPMorgan. EA shareholders will receive $210 per share, a 25% premium over its pre-deal price. The transaction positions EA to accelerate long-term strategic growth, particularly around its flagship sports titles, while contributing to Saudi Arabia’s ambitions to diversify beyond oil by investing in global gaming.

Source: Reuters

LAST WEEK TECHNICAL QUESTION OF THE WEEK ANSWER:

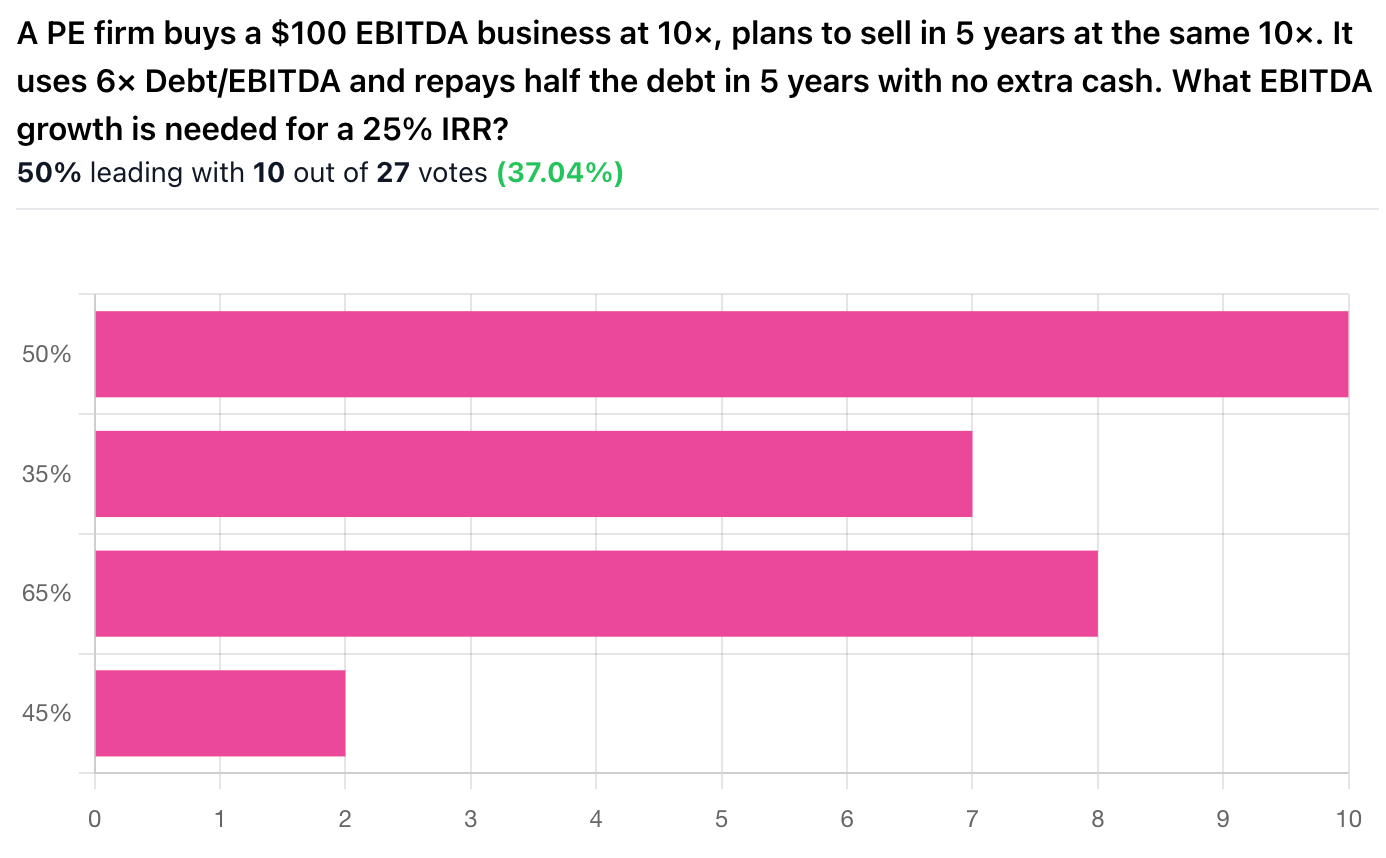

Correct Answer: A, 50% — A PE firm buys a $100 EBITDA business at 10×, plans to sell in 5 years at the same 10×. It uses 6× Debt/EBITDA and repays half the debt in 5 years with no extra cash. What EBITDA growth is needed for a 25% IRR?

Explanation: The firm invests $400m equity ($1,000m purchase price at 10× EBITDA minus $600m debt), and at exit the valuation stays at 10×, so equity value grows as EBITDA increases and debt decreases. With half the $600m debt repaid, $300m remains, meaning the exit equity value must be about $1,220m for a 25% IRR over 5 years. That requires EBITDA to double from $100m to $150m, i.e., 50% growth.