- First Step to Final Offer

- Posts

- First Step to Final Offer 8/19/25

First Step to Final Offer 8/19/25

Your weekly round-up of an M&A deal walkthrough, insightful market news summaries, technical quiz questions, and various internships, events, and diversity programs. A key resource to best prepare yourself for finance recruiting. If someone sent you the newsletter subscribe below!

CAREER OPPORTUNITIES

RecruitU Opportunities

RecruitU is building an AI-native career platform that Gen Z will trust to navigate their early careers, starting with the most competitive paths in finance and consulting.

We are hiring Product Growth Interns to help run the playbook and shape RecruitU’s student growth engine. This opportunity is ideal for students headed into IB, consulting, or VC who want hands-on startup experience, mentorship, and a real leadership role with scope, visibility, and impact.

RecruitU Partner Opportunities

RecruitU partners are companies that have recruiters actively using RecruitU to find students for their full-time and internship roles. So if you’re signed up, you have direct visibility with these companies.

Class of 2026 Finance and Consulting Opportunities

L.E.K. Consulting U.S. Summer Associate - 2026 Link

Scotiabank 2026 Investment Banking Analyst, Energy Link

MUFG Intrepid Investment Bankers- 2026 Investment Banking Analyst - Multiple Roles and Locations Link

Guggenheim Partners 2026 Guggenheim Securities Investment Banking Analyst – Los Angeles Aerospace & Defense Link

Houlihan Lokey Investment Banking Financial Analyst - Multiple Roles and Locations Link

Raymond James Financial 2026 Investment Banking Analyst - Multiple Roles and Locations Link

Class of 2027 Finance Opportunities

Rockefeller Capital Management Summer Analyst - Equity Portfolio Management - Multiple Roles and Locations Link

MUFG 2026 Summer Analyst - Multiple Roles and Locations Link

Bain Capital 2026 Analyst, Liquid Structured Credit - Multiple Roles Link

BNP Paribas 2026 - Summer Analyst Internship - Multiple Roles and Locations Link

Kroll Intern, Mergers & Acquisitions Link

Lincoln International 2026 Summer Analyst Intern, Valuations & Opinions Group Link

Class of 2027 Consulting Opportunities

To see c/o 2027 opportunities, click here: Class of 2027 Application Tracker

Class of 2028 Consulting Opportunities

KPMG Advisory Seasonal Intern, Customer & Operations | New York Summer 2026 Link

TECHNICAL QUESTION OF THE WEEK:

What is the market cap for a company that has... $2bn in assets, 3x Debt to Equity, 2x P / BV...? |

MARKET NEWS

Citi Intensifies Hiring Spree with Ex-JPMorgan Bankers

Citigroup’s head of banking, Vis Raghavan, has accelerated his recruitment drive since the expiry of his non-solicit agreement with JPMorgan, bringing over at least 10 senior investment bankers from his former employer. High-profile hires include Amit Nayyar, Guillermo Baygual, and Pankaj Goel, alongside other senior figures, strengthening Citi’s leadership ranks as part of Raghavan’s turnaround strategy. The bank, now fifth globally in investment banking revenue, has also added senior talent from Goldman Sachs and Ares Management, while its fees rose 13% in Q2 on major deals such as Nippon Steel’s $15bn acquisition of US Steel.

Source: Financial Times

Private Credit Moves Into Football With Transfer Fee-Backed Loans

Europe’s record $5 billion summer transfer window has fueled a surge in private credit firms using player transfer fees as collateral for loans. Apollo and Blackstone are among the major investors eyeing deals, as clubs increasingly monetize multi-year installment payments from player sales. While top teams rely on traditional financing, smaller clubs see these receivable-backed loans as vital lifelines. Pricing varies widely: typical transfer-backed notes carry coupons around 500 basis points over benchmarks (about 8–9%), with some deals lower at 300 bps and as little as 150 bps for top-tier credits

Source: Bloomberg

M&A DEAL OVERVIEW

BlackRock’s GIP Agreed to Buy Nearly Half of Eni’s Carbon Capture Unit

BlackRock’s Global Infrastructure Partners has agreed to acquire a 49.99% stake in Eni’s carbon capture and storage business as part of the Italian energy group’s strategy to bring in partners for its satellite ventures. The unit, which includes projects in Britain and the Netherlands and rights to Italy’s Ravenna initiative, will see investment costs shared between the two firms. Eni’s CEO said the deal strengthens its ability to deliver advanced decarbonisation solutions, while GIP highlighted its expertise in infrastructure to scale the technology, which remains debated over costs and long-term viability.

Source: Reuters

LAST WEEK TECHNICAL QUESTION OF THE WEEK ANSWER:

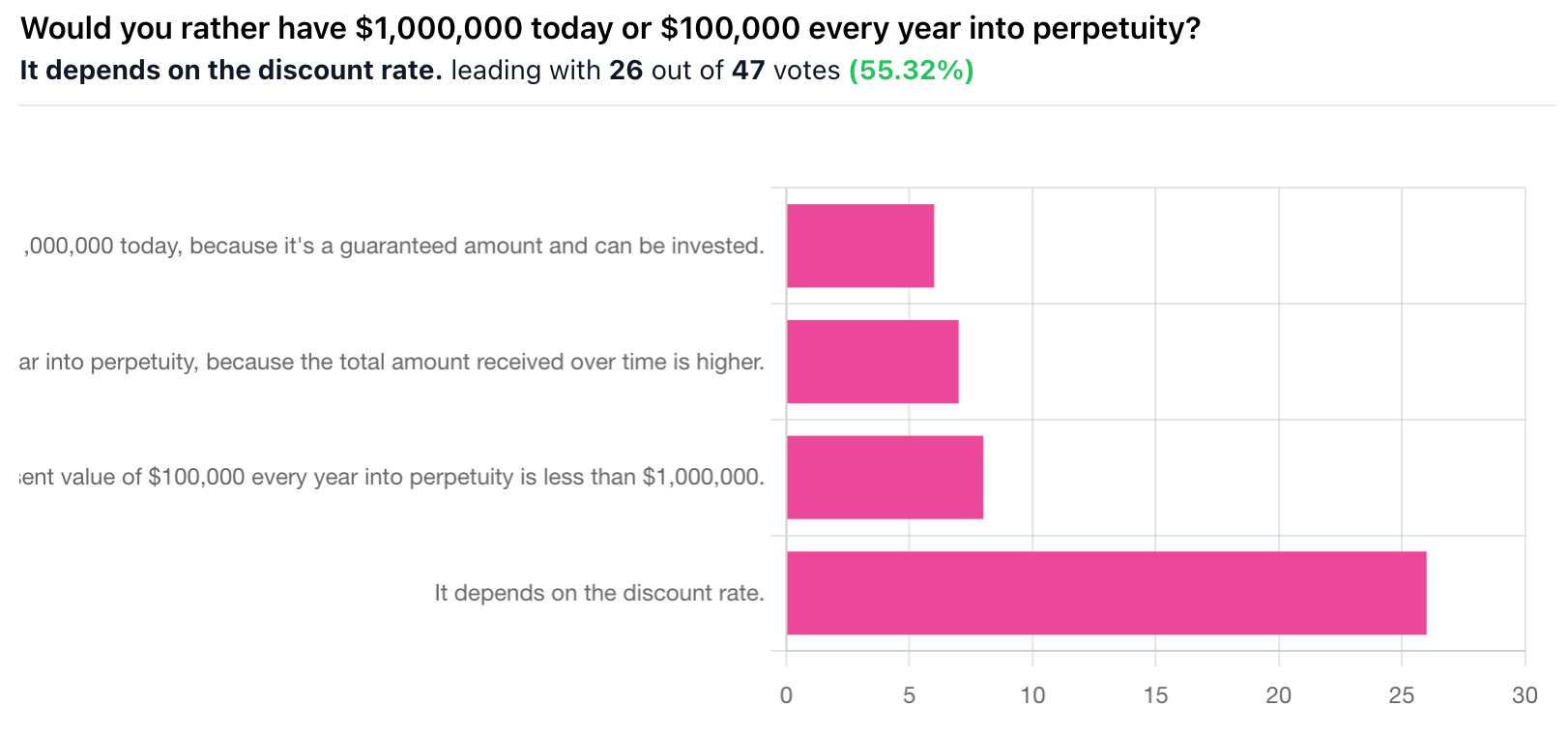

Correct Answer: D, It depends on the discount rate. — Would you rather have $1,000,000 today or $100,000 every year into perpetuity?

Explanation: The choice depends on the discount rate: if the present value of receiving $100,000 every year forever (calculated as $100,000 ÷ discount rate) is greater than $1,000,000, then the perpetuity is more valuable; if it is less, then taking the $1,000,000 today is better.