- First Step to Final Offer

- Posts

- First Step to Final Offer 7/15/25

First Step to Final Offer 7/15/25

Your weekly round-up of an M&A deal walkthrough, insightful market news summaries, technical quiz questions, and various internships, events, and diversity programs. A key resource to best prepare yourself for finance recruiting. If someone sent you the newsletter subscribe below!

CAREER OPPORTUNITIES

RecruitU Opportunities

RecruitU is building an AI-native career platform that Gen Z will trust to navigate their early careers, starting with the most competitive paths in finance and consulting.

We are hiring Product Growth Interns to help run the playbook and shape RecruitU’s student growth engine. This opportunity is ideal for students headed into IB, consulting, or VC who want hands-on startup experience, mentorship, and a real leadership role with scope, visibility, and impact.

RecruitU Partner Opportunities

RecruitU partners are companies that have recruiters actively using RecruitU to find students for their full-time and internship roles. So if you’re signed up, you have direct visibility with these companies.

Class of 2026 Finance Opportunities

Capital One Strategy Consulting Associate - 2026 Link

Bain & Company Associate Consultant Internship Link

Houlihan Lokey Financial Analyst (Class of 2026) - Financial Restructuring - Minneapolis Link

Citadel and Citadel Securities Investment & Trading – Intern (US) Link

Citadel and Citadel Securities Equities – Citadel Associate Program – Full Time Program 2026 (US) Link

Oliver Wyman Entry Level Consultant 2026 - US Link

Class of 2027 Finance Opportunities

To see c/o 2027 opportunities, click here: Class of 2027 Application Tracker

TECHNICAL QUESTION OF THE WEEK:

Assume that Company A has 10 shares outstanding at a share price of $25.00, and its Net Income is $10. It acquires Company B for a Purchase Equity Value of $150. Company B has a Net Income of $10 as well.Assume the same tax rates for both companies. How accretive is this deal? |

MARKET NEWS

Morgan Stanley, Goldman Agree to $120 Million Settlement Over Archegos Trades

Morgan Stanley, Goldman Sachs, and Wells Fargo have agreed to a $120 million settlement with ViacomCBS investors, who alleged the banks concealed conflicts of interest during their dealings with Archegos Capital Management. The lawsuit stemmed from the banks’ dual roles as both underwriters of Viacom’s 2021 stock offering and prime brokers to Archegos, whose collapse triggered billions in losses. While the firms deny wrongdoing, they chose to settle to avoid the costs and disruptions of prolonged litigation.

Source: Bloomberg

Investment Banking Set to Extend Prolonged Slump

Investment banking is poised to deliver its weakest run in over a decade, contributing less than 25% of Wall Street revenue at the five largest U.S. banks for the 14th consecutive quarter. Analysts expect investment banking revenue to fall nearly 10% to $7.5 billion, while trading revenues are projected to rise by a similar margin, hitting $31 billion. The ongoing drought in dealmaking and equity issuance has prolonged the downturn, despite continued optimism about a recovery later in the year.

Source: Financial Times

M&A DEAL OVERVIEW

Bain Capital & Kohlberg Lead $10 Billion Investment in PCI Pharma Services

Bain Capital, in its first stake in PCI Pharma Services, is teaming up with Kohlberg and existing backers to invest in the Philadelphia-based drug-services firm at a valuation of around $10 billion. The private equity group Kohlberg, which originally acquired the company alongside Mubadala in 2020, will reinvest alongside Partners Group. PCI provides critical fill-finish capabilities for clinical trial injectables and supports the manufacturing and packaging of prescription drugs. The fresh capital will fuel expansion across its global footprint.

Source: Private Equity Insights

LAST WEEK TECHNICAL QUESTION OF THE WEEK ANSWER:

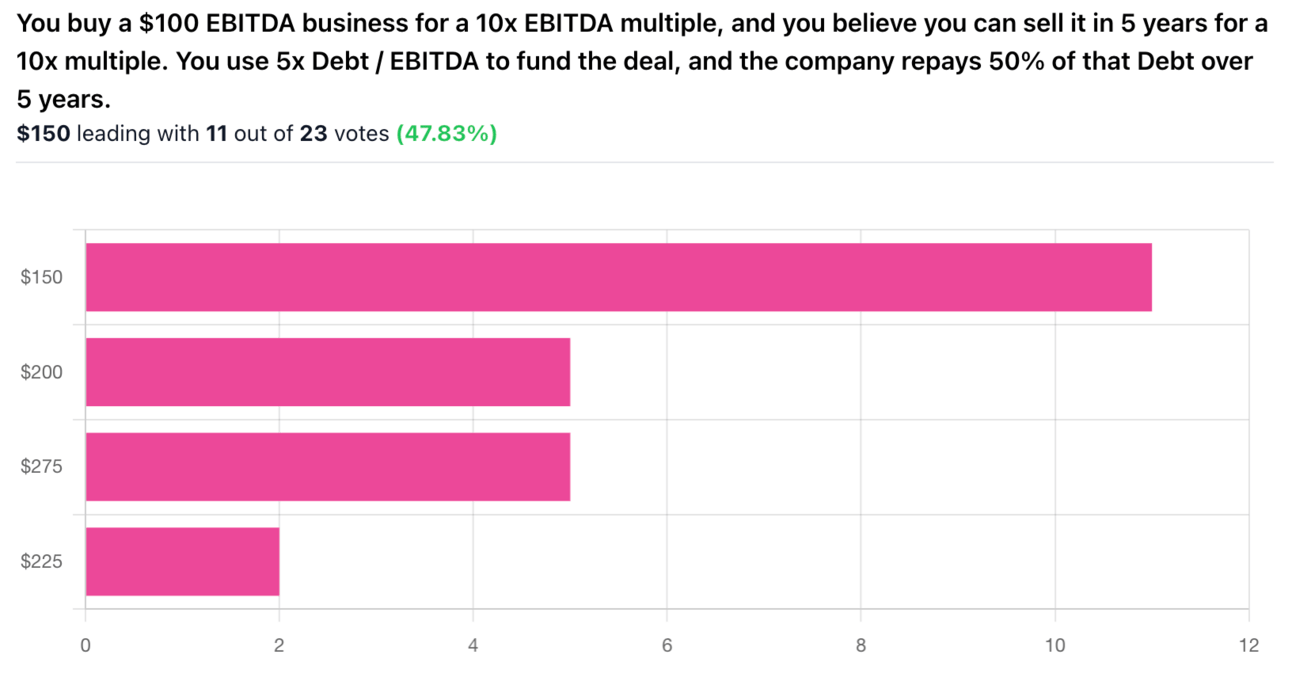

Correct Answer: A, $150. — You buy a $100 EBITDA business for a 10x EBITDA multiple, and you believe you can sell it in 5 years for a 10x multiple. You use 5x Debt / EBITDA to fund the deal, and the company repays 50% of that Debt over 5 years. How much does EBITDA need to grow over 5 years to realize a 20% IRR?

Explanation: To achieve a 20% IRR on this deal, EBITDA needs to grow from $100 to $150 over 5 years. Here's why: You initially buy the company for $1,000 (10x EBITDA), using $500 in equity (the other $500 is 5x debt). If the company repays half the debt, $250 remains at exit. To achieve a 20% IRR on your $500 equity investment, you need to exit with $1,244 in equity value after 5 years. This implies a total enterprise value of $1,494 ($1,244 equity + $250 remaining debt). At a 10x exit multiple, that means EBITDA must be $149.4—rounded to $150.