- First Step to Final Offer

- Posts

- First Step to Final Offer 12/30/25

First Step to Final Offer 12/30/25

Your weekly round-up of an M&A deal walkthrough, insightful market news summaries, technical quiz questions, and various internships, events, and diversity programs. A key resource to best prepare yourself for finance recruiting. If someone sent you the newsletter subscribe below!

CAREER OPPORTUNITIES

Class of 2028 Finance Opportunities

Deutsche Bank Internship Program 2027 - Multiple Roles and Locations Link

Lazard 2027 Financial Advisory Summer Analyst Program - Multiple Roles Link

Moelis & Company 2027 Summer Analyst, Investment Banking - Boston - Multiple Roles and Locations Link

JPMorgan Chase & Co. 2027 Summer Analyst Program - Multiple Roles and Locations Link

Silversmith Capital Partners Summer Analyst 2027 Link

Baird Internship - Investment Banking Analyst (Summer 2027) - Multiple Roles and Locations Link

Audax Group Summer Analyst, Private Debt Origination (2027) Link

Raymond James Financial 2027 Investment Banking Summer Analyst - Multiple Roles and Locations Link

BNP Paribas 2027 - Summer Analyst Internship - Multiple Roles and Locations Link

To see c/o 2028 opportunities, click here: Class of 2028 Application Tracker

Class of 2027 Finance and Consulting Opportunities

Lazard 2026 Summer Internship - Client Services Analyst - Lazard Wealth Link

JPMorgan Chase & Co. 2026 Global Private Bank Advisor Program (Summer Analyst) - US Private Bank Link

Goldman Sachs 2026 | Americas | New York | Asset Management, Quantitative Investing (Wealth Investment Solutions) | Summer Analyst Link

Scotiabank 2026 Corporate Banking Internship Media & Telcom, NYC Link

KeyBank 2026 KeyBank Summer Internship - Structured Finance - Superior, CO Link

KeyBank 2026 Equity Research Summer Analyst New York Link

To see c/o 2027 opportunities, click here: Class of 2027 Application Tracker

Class of 2026 Finance and Consulting Opportunities

Nomura Securities International 2026 Global Markets Full-Time Analyst Program – Structured Funding Trading Link

Piper Sandler Public Finance Investment Banking Intern - Hospitality Link

Piper Sandler Public Finance Investment Banking Analyst - Healthcare Link

Scotiabank 2026 Investment Banking Analyst Energy, Houston Link

TECHNICAL QUESTION OF THE WEEK:

A company with a higher P/E acquires one with a lower P/E – is this accretive or dilutive? |

MARKET NEWS

Apollo Spins Out Hybrid Lending Arm as Focus Shifts from Traditional Buyouts

Apollo has carved out its high-growth hybrid capital unit from its core buyout division, signaling a deeper pivot toward private credit. The newly independent team, led by Matt Nord, specializes in complex lending deals often paired with minority equity stakes and has delivered nearly 20% annualized returns since early 2024—far outpacing the less than 8% returns from recent buyouts. CEO Marc Rowan underscored that private equity, while still important, is “not a growth business,” as Apollo prioritizes financing for AI and infrastructure-linked companies through more customized, off-balance-sheet structures.

Source: Financial Times

Publicly Traded Private Credit Funds Head for Worst Year Since 2020

Business development companies (BDCs), key players in private credit, are set to post their weakest performance relative to the S&P 500 since 2020. The Cliffwater BDC Index fell 6.6% through December 24, compared to an 18.1% gain for the S&P 500, as shrinking spreads, slower deal activity, and investor redemptions weighed on returns. With rates expected to fall and returns dipping into single digits, firms like Blue Owl and Blackstone face growing skepticism and short seller activity, forcing a shift toward newer structures like interval funds that promise more liquidity and broader asset access.

Source: Bloomberg

M&A DEAL OVERVIEW

SoftBank to Acquire DigitalBridge for $4 Billion to Boost AI Infrastructure

SoftBank will acquire digital infrastructure firm DigitalBridge in a $4 billion deal as it accelerates its push into artificial intelligence. The transaction includes a $16-per-share offer, representing a 15% premium, and is expected to close in the second half of 2026. DigitalBridge, which manages $108 billion in assets, will continue operating independently under CEO Marc Ganzi. The acquisition expands SoftBank’s exposure to data centers, cell towers, and edge infrastructure, aligning with its strategy to support high-demand AI computing capacity through initiatives like the Stargate project.

Source: Reuters

LAST WEEK TECHNICAL QUESTION OF THE WEEK ANSWER:

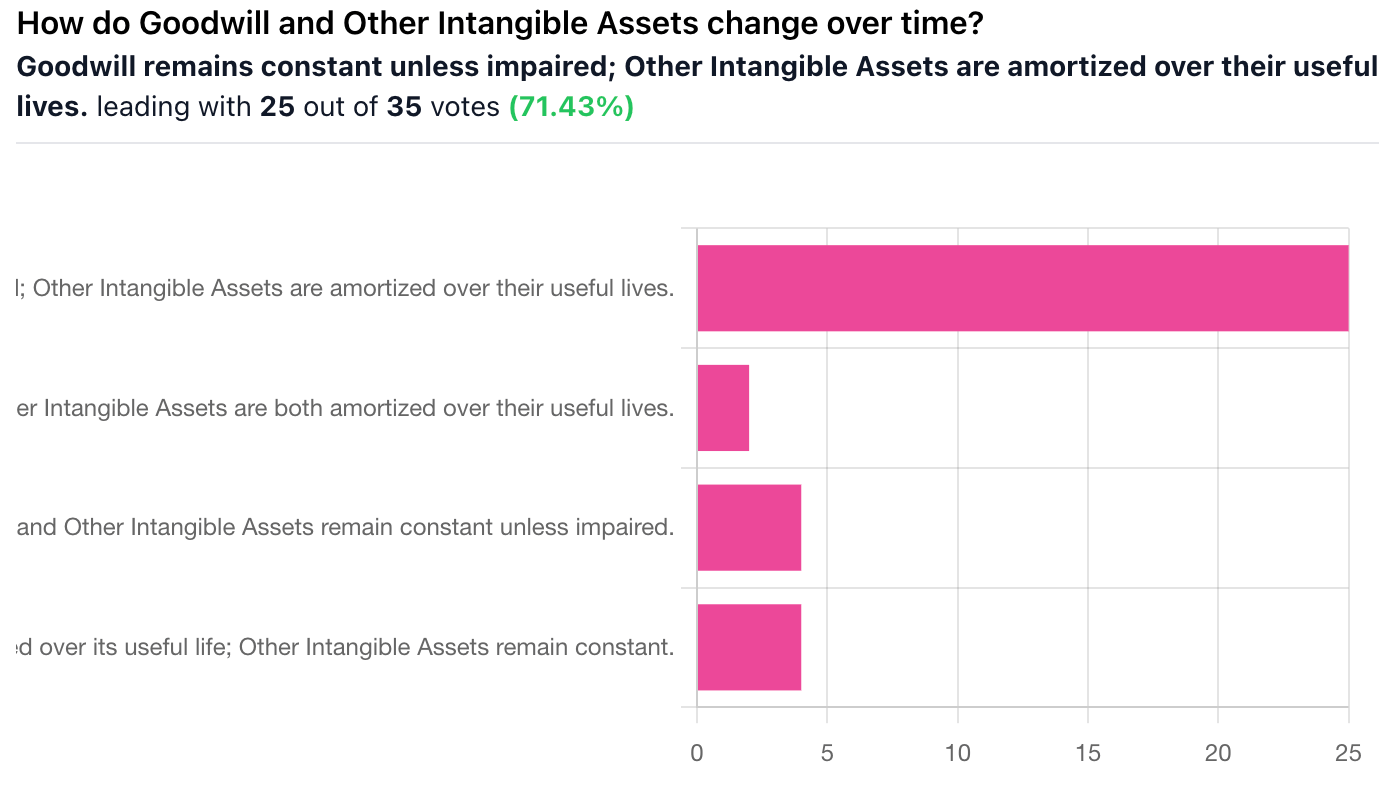

Correct Answer: A, Goodwill remains constant unless impaired; Other Intangible Assets are amortized over their useful lives. — How do Goodwill and Other Intangible Assets change over time?

Explanation: Goodwill and other intangible assets behave differently over time because of how accounting rules treat them. Goodwill remains constant on the balance sheet after an acquisition unless it is tested and found to be impaired, in which case it is written down; it is not amortized. Other intangible assets, such as patents, customer relationships, or trademarks with finite lives, are amortized over their estimated useful lives, reducing their book value each period and creating a non-cash expense on the income statement.