- First Step to Final Offer

- Posts

- First Step to Final Offer 12/23/25

First Step to Final Offer 12/23/25

Your weekly round-up of an M&A deal walkthrough, insightful market news summaries, technical quiz questions, and various internships, events, and diversity programs. A key resource to best prepare yourself for finance recruiting. If someone sent you the newsletter subscribe below!

CAREER OPPORTUNITIES

Class of 2028 Finance Opportunities

RBC Capital Markets 2027 Capital Markets, Real Estate Capital Partners Summer Analyst Link

LionTree 2027 US Advisory Summer Analyst - NY Link

Jefferies Class of 2028: U.S. Women in Research Mentorship Program Link

Houlihan Lokey Summer 2027 Financial Analyst (Class of 2028) - Multiple Roles and Locations Link

Deloitte Corporate Finance Summer Analyst Link

Citi Banking - Investment Banking, Summer Analyst - Multiple Roles and Locations Link

Barclays Banking Analyst Summer Internship Program 2027 - Multiple Roles and Locations Link

To see c/o 2028 opportunities, click here: Class of 2028 Application Tracker

Class of 2027 Finance and Consulting Opportunities

CIBC 2026 Summer Intern - Multiple Roles and Locations Link

Blackstone 2026 Blackstone Finance - BXCI Finance Summer Analyst Link

Forvis Consultant Financial Services Regulatory Summer 2026 | Multiple Locations Link

LPL Financial 2026 Summer Internship - Multiple Roles and Locations Link

Boston Consulting Group Risk Management - Enterprise Risk Intern Link

West Monroe 2026 Business & Strategy Consulting Intern - Multiple Roles and Locations Link

UBS Private Wealth Internship Link

Huron Healthcare Summer 2026 Consulting Intern, Chicago (Spring 2027 Graduates) Link

Oliver Wyman 2026 Summer Analyst – Veritas, A Business of Oliver Wyman Link

To see c/o 2027 opportunities, click here: Class of 2027 Application Tracker

Class of 2026 Finance and Consulting Opportunities

TECHNICAL QUESTION OF THE WEEK:

MARKET NEWS

BofA to Boost Investment Banker Bonuses After Strong Year in Deals

Bank of America will raise bonus payouts for top-performing investment bankers by around 20%, reflecting a strong year in dealmaking. The bank also plans to increase its overall bonus pool for the investment banking division, while payouts for mid-level performers may remain flat. This marks a sharper rise compared to last year’s average 10% bonus increase. BofA ranked third globally in investment banking revenue for 2025 and aims to grow its fee share by up to 1% over the next few years, with plans to focus on mega deals, middle-market expansion, and strategic hires.

Source: Reuters

Citadel Set for Weakest Year Since 2018 as Gas Trades Lag

Citadel’s flagship fund is up 9.3% for the year through December 18, on pace for its lowest annual return since 2018. While gains were recorded across equities, credit, and macro strategies, underperformance in natural gas trades weighed on overall results. The firm has expanded into physical energy trading, including deals in U.S. shale and European power markets, as it positions for future energy demand growth.

Source: Bloomberg

M&A DEAL OVERVIEW

KKR Emerges as Lead Bidder for Japan’s Taiyo in $3.5 Billion Deal Talks

KKR has surfaced as the frontrunner to acquire Japanese chemical firm Taiyo Holdings, outpacing rival private equity bidders. The two sides are in advanced talks to finalize an offer, which could be priced below Taiyo’s current share price. Despite a sharp intraday drop of 9.3%, Taiyo shares have climbed nearly 130% this year, valuing the company at around $3.5 billion. Discussions are ongoing with no guarantee of a deal, as other suitors remain in the mix.

Source: Bloomberg

LAST WEEK TECHNICAL QUESTION OF THE WEEK ANSWER:

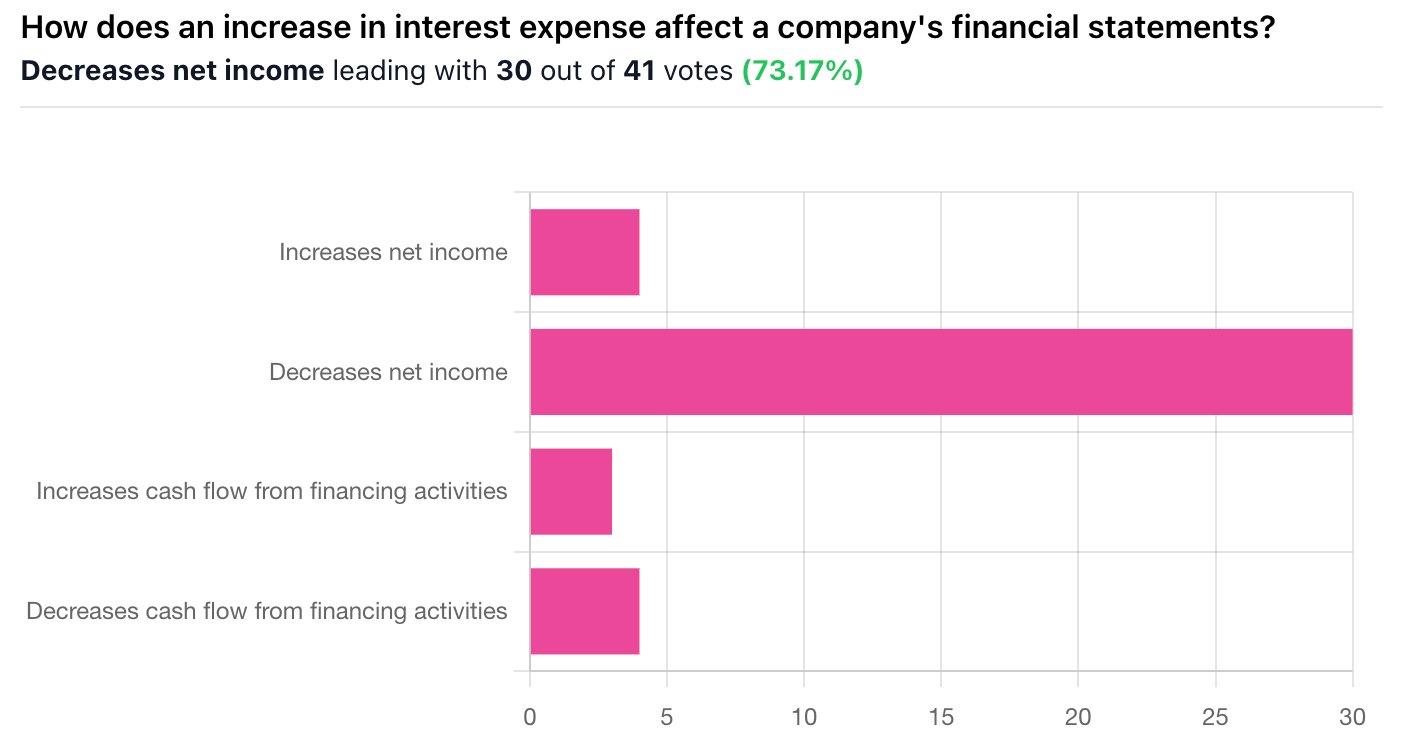

Correct Answer: B, Decreases net income. — How does an increase in interest expense affect a company's financial statements?

Explanation: An increase in interest expense decreases net income because interest is an expense on the income statement that reduces pre-tax earnings; after accounting for taxes, lower pre-tax income flows directly into lower net income. This reduction in net income also lowers retained earnings on the balance sheet, and on the cash flow statement, the higher interest expense reduces cash flow from operations by the after-tax amount of the additional interest paid.