- First Step to Final Offer

- Posts

- First Step to Final Offer 11/11/25

First Step to Final Offer 11/11/25

Your weekly round-up of an M&A deal walkthrough, insightful market news summaries, technical quiz questions, and various internships, events, and diversity programs. A key resource to best prepare yourself for finance recruiting. If someone sent you the newsletter subscribe below!

CAREER OPPORTUNITIES

Class of 2026 Finance and Consulting Opportunities

Charles River Associates (2026 Bachelor's/Master's graduates) Consulting Analyst/Associate - Multiple Roles and Locations Link

Bank of America 2026 Global Corporate Banking Full Time Analyst Program – Houston (GCIB Analyst Program) Link

Houlihan Lokey 2026 Financial Analyst (Class of 2026), Portfolio Valuation and Fund Advisory Services - Multiple Roles and Locations Link

Class of 2027 Finance and Consulting Opportunities

RBC Capital Markets First in Finance WM Internship Program, 2026 - NYC Link

RBC Capital Markets 2026 GAM Fixed Income & Business Management Summer Internship Link

Teneo Financial Advisory Intern, Summer 2026 Internship Program Link

CIBC 2026 Summer Intern - Equity Research Milwaukee Link

Summit Partners Summer Growth Equity Analyst Link

PJT Partners 2026 Summer Analyst - Corporate Rotational Program Link

Houlihan Lokey 2026 Investment Banking Summer Financial Analyst (Class of 2027) - Multiple Roles and Locations Link

Goldman Sachs 2026 | Americas | New York City Area | Global Investment Research, Equity Research | Seasonal/Off-Cycle Link

Baird Internship – Private Asset Management, Client Services (Year-Round) Link

Baird Internship – Private Wealth Management (Henderson, KY Summer 2026) Link

LPL Financial 2026 Summer Internship- Wealth Management Summer Intern Link

Susquehanna Equity Analyst Internship: Summer 2026 Link

Charles River Associates (2026 Bachelor's/Master's graduates) Consulting Analyst/Associate Intern - Multiple Roles and Locations Link

To see c/o 2027 opportunities, click here: Class of 2027 Application Tracker

Class of 2028 Finance Opportunities

Leerink Partners 2027 Investment Banking Summer Analyst Program Link

TECHNICAL QUESTION OF THE WEEK:

If you have an increase of $10 on the financial statements, what is the net effect on cash flow from operations (assume 50% tax rate)? |

MARKET NEWS

Private Equity Firms Turn to Off-Balance Sheet Debt to Unlock IPO Returns

Faced with IPO markets that no longer guarantee full exits and wary of burdening portfolio companies with added debt, private equity firms are adopting creative alternatives to cash out. Hellman & Friedman, for instance, recently cut its stake in Verisure Plc by combining a traditional IPO with a €1 billion payout funded through a special-purpose vehicle (SPV) separate from Verisure’s balance sheet. This structure—using payment-in-kind (PIK) debt at the holding company level—enabled the firm to avoid spooking public investors while securing upfront liquidity. With Verisure’s leverage ratio dropping post-IPO, analysts say this off-balance-sheet approach may become a new model for sponsors navigating the post-zero-rate era.

Source: Bloomberg

Hedge Funds Slash Consumer Stock Holdings to Pandemic-Era Lows, Goldman Data Reveals

According to a Goldman Sachs note dated November 7, 2025, hedge funds sharply reduced their exposure to consumer discretionary stocks—particularly those linked to spending on non-essential goods such as hotels, restaurants, and leisure. Long positions were liquidated and short bets increased, driving exposure to the lowest levels seen since the onset of the COVID-19 pandemic in 2020. In contrast, hedge funds significantly boosted their holdings in U.S. health care stocks for the eighth consecutive week, marking the fastest buying pace in nine months. The rotation reflects growing caution amid weak U.S. economic data, surging layoffs, and consumer sentiment hitting a 3.5-year low in early November.

Source: Reuters

M&A DEAL OVERVIEW

KKR Sells Aerospace Supplier Novaria Group to Arcline for $2.2 Billion

KKR has agreed to sell aerospace and defense parts maker Novaria Group to Arcline Investment Management for $2.2 billion, marking a notable sponsor-to-sponsor transaction as private equity exits regain momentum. Since acquiring Novaria in early 2020, KKR expanded the company by integrating 13 additional businesses, benefiting from rising global defense budgets, increased aircraft production, and supply chain reinvestment. Novaria supplies components for aircraft, drones, and submersibles. The deal reflects a broader revival in private equity exits, with KKR highlighting the supportive backdrop in aerospace and defense, driven by geopolitical tensions and heightened national security spending

Source: Reuters

LAST WEEK TECHNICAL QUESTION OF THE WEEK ANSWER:

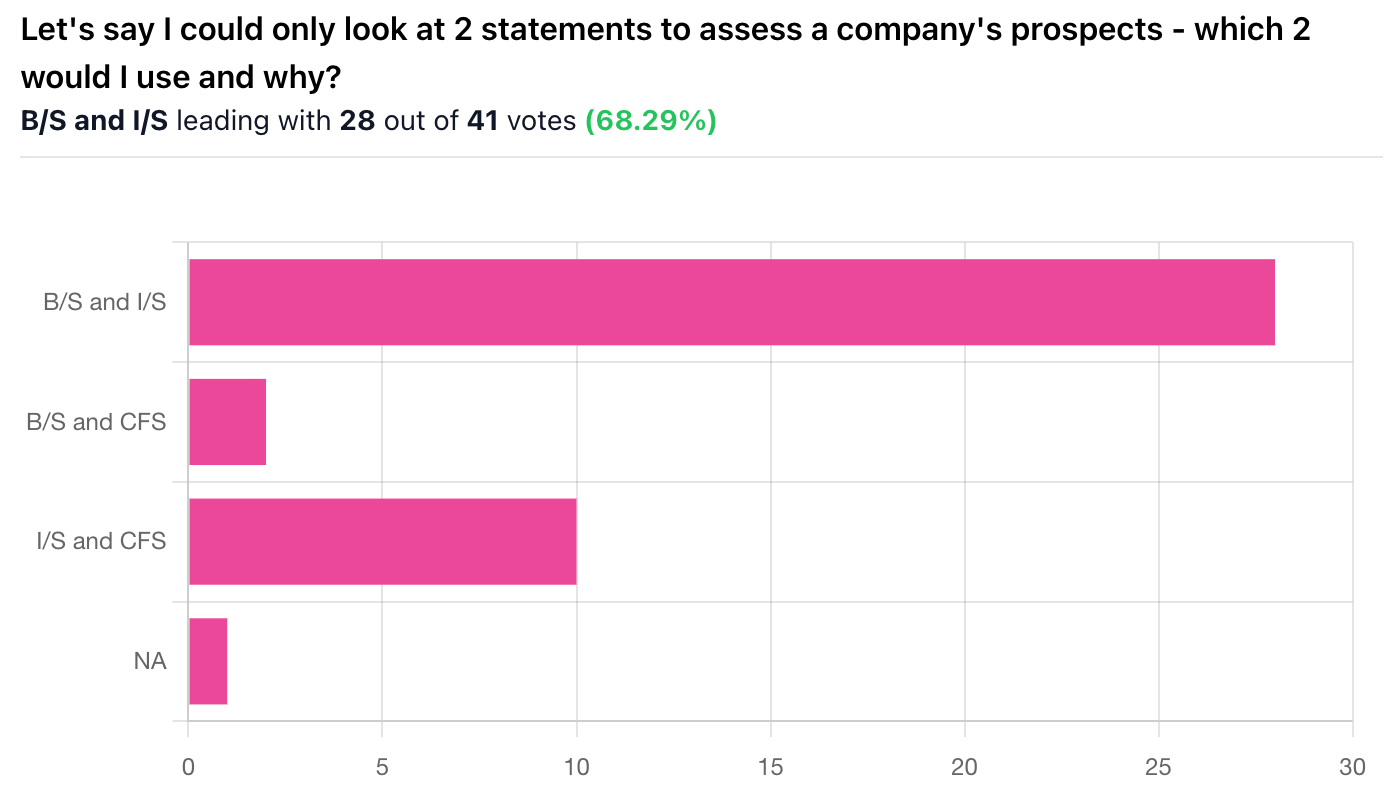

Correct Answer: A, B/S and I/S — Let's say I could only look at 2 statements to assess a company's prospects - which 2 would I use and why?

Explanation: These two statements together give the best overview of a company’s financial health and performance. The income statement shows profitability, growth, and operating efficiency over time, while the balance sheet reveals the company’s assets, liabilities, and overall financial position. Together, they allow you to assess both how well the company is performing and how stable its financial foundation is.