- First Step to Final Offer

- Posts

- First Step to Final Offer 10/7/25

First Step to Final Offer 10/7/25

Your weekly round-up of an M&A deal walkthrough, insightful market news summaries, technical quiz questions, and various internships, events, and diversity programs. A key resource to best prepare yourself for finance recruiting. If someone sent you the newsletter subscribe below!

CAREER OPPORTUNITIES

RecruitU Partner Opportunities

North Highland Summer Intern 2026 Link

RecruitU partners are companies that have recruiters actively using RecruitU to find students for their full-time and internship roles. So if you’re signed up, you have direct visibility with these companies.

Class of 2026 Finance and Consulting Opportunities

AIG 2026 – Early Career – Finance – Analyst – United States, New York (NY) Link

Ares Management 2026 Analyst – Private Equity Link

CIBC 2026 Commercial Banking Full-Time Analyst - Training Program Link

Citi Wealth – Full-time Analyst, New York – USA, 2026 Link

Hennepin Partners Investment Banking Analyst Link

Mars & Co Summer Associate Consultant - NY Area Link

Financial Technology Partners 2027 January IBD Full Time Analyst (San Francisco) Link

Jefferies Group 2026 Investment Banking Analyst - San Francisco, Technology, Media & Telecom Group Link

JPMorgan Chase & Co. 2026 Asset Management Product Program - Full-time Analyst Link

Class of 2027 Finance Opportunities

Piper Sandler 2026 Summer Internship Program - Multiple Roles and Locations Link

LPL Financial 2026 Summer Internship- Wealth Management Summer Intern Link

RBC Capital Markets 2026 Portfolio Strategy Summer Internship - USWM Link

Stout Intern Summer 2026, Real Estate - Multiple Roles and Locations Link

UBS 2026 Tomorrow’s Talent Program – Investment Banking Insights - NY Link

UBS 2026 Sophomore Internship - Global Markets - New York Link

Millennium Management LLC Internship, New York - Multiple Roles Link

D.A. Davidson Companies 2026 Summer Internship Program - Multiple Roles and Locations Link

Lazard 2026 Financial Institutions Group Internship Link

Lazard 2026 Institutional Client Group Summer Internship Link

PGIM 2026 Private & Public Fixed Income, Sophomore Externship Program Link

PGIM 2026 Fixed Income, Summer Investment Analyst Program (Portfolio Analysis Group) Link

BNP Paribas 2026 - Summer Analyst Internship - Corporate Finance (Investment Banking, Leveraged Finance, Equity Capital Markets) Link

Citi Summer Analyst, USA, 2026 - Multiple Roles and Locations Link

Blackstone 2026 Strategic Partners GP Stakes, SVT Summer Analyst Link

The Raine Group LLC 2027 Summer Analyst (New York) Link

Insight Partners 2027 Summer Investment Analyst Link

The Riverside Company 2027 Riverside Micro Cap Summer Analyst Link

AIG 2026 – Early Career – Finance – Summer Intern – Multiple Roles and Locations Link

Class of 2027 Consulting Opportunities

To see c/o 2027 opportunities, click here: Class of 2027 Application Tracker

Class of 2028 Finance and Consulting Opportunities

The Riverside Company 2027 Riverside Micro Cap Summer Analyst Link

UBS 2026 Sophomore Internship - Global Markets - New York Link

Insight Partners 2027 Summer Investment Analyst Link

The Raine Group LLC 2027 Summer Analyst (New York) Link

Oliver Wyman Oliver Wyman - Integrated Consulting Group Intern 2026 Link

Deloitte Deloitte Consulting LLP - Government & Public Services - Discovery Intern (Sophomore) - DC (Summer 2026) Link

PGIM 2026 Private & Public Fixed Income, Sophomore Externship Program Link

Millennium Management LLC Corporate Strategy Intern, New York Link

UBS 2026 Tomorrow’s Talent Program – Investment Banking Insights - NY Link

TECHNICAL QUESTION OF THE WEEK:

An Acquirer with an Equity Value of $500M and Enterprise Value of $600M has Net Income of $50M and EBITDA of $100M. The Target, purchased for an Equity Value of $100M and Enterprise Value of $150M, has Net Income of $10M and EBITDA of $15M.In a 100% Stock deal, assuming equal tax rates, what are the combined P/E and TEV/EBITDA multiples? |

MARKET NEWS

JPMorgan’s $500M Fee on EA Buyout Sparks Scramble Among Global Banks

JPMorgan Chase is set to earn a massive $500 million in fees for underwriting $20 billion in debt financing for Electronic Arts’ record $55 billion buyout, led by Silver Lake, Affinity Partners, and Saudi Arabia’s PIF. This unprecedented debt commitment—the largest ever by a single bank for an LBO—is drawing interest from a global syndicate of lenders eager for a share. Banks will split the fee proportionally based on participation, with plans to sell down dual-currency leveraged loans and high-yield bonds by 2026. The move reflects Wall Street’s reassertion in mega-deal financing over private credit.

Source: Bloomberg

AI Startups Attract Nearly Half of Global Venture Funding in Q3 as Investment Surges

Venture funding in the third quarter of 2025 soared to $97 billion globally, a 38% year-over-year increase, with artificial intelligence companies capturing 46% of that total, according to Crunchbase data. Anthropic alone received nearly $13 billion, accounting for 29% of global AI funding. Other major recipients included xAI with $5.3 billion and Mistral AI with $2 billion. U.S.-based startups dominated the quarter, raising $60 billion. The boom in AI investment helped propel stock indexes to record highs and positioned OpenAI as the world’s most valuable private company at a $500 billion valuation.

Source: Reuters

M&A DEAL OVERVIEW

Ares Management Acquires 49% Stake in EDPR’s U.S. Clean Energy Assets in $2.9B Deal

Ares Management has purchased a 49% stake in a diversified U.S. renewable energy platform owned by EDP Renováveis (EDPR), valuing the business at approximately $2.9 billion. The deal adds 1.6 gigawatts of capacity—spanning solar, wind, and battery storage—across four U.S. power markets, all backed by long-term contracts averaging 18 years. This marks a major expansion for Ares’ Infrastructure Opportunities funds, which now own roughly 5.7 gigawatts across 11 states. The move reflects Ares’ continued focus on energy infrastructure as power demand rises due to data centers and AI growth.

Source: Reuters

LAST WEEK TECHNICAL QUESTION OF THE WEEK ANSWER:

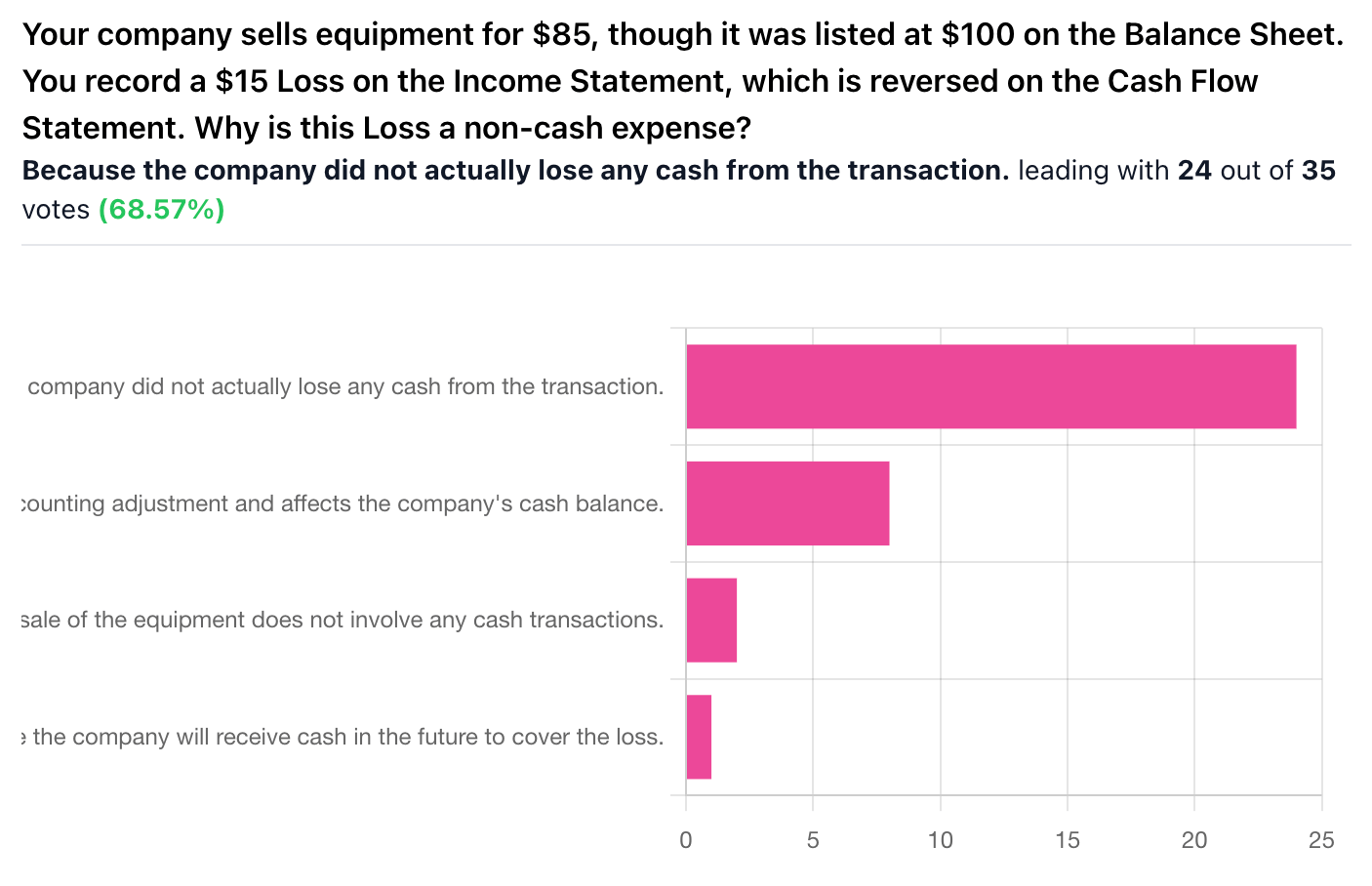

Correct Answer: A, Because the company did not actually lose any cash from the transaction. — Your company sells equipment for $85, though it was listed at $100 on the Balance Sheet. You record a $15 Loss on the Income Statement, which is reversed on the Cash Flow Statement. Why is this Loss a non-cash expense?

Explanation: The $15 loss is non-cash because it represents an accounting adjustment reflecting that the equipment’s book value exceeded the sale price, but no actual cash was lost—only the difference between accounting value and sale proceeds—so it’s added back on the cash flow statement.