- First Step to Final Offer

- Posts

- First Step to Final Offer 10/28/25

First Step to Final Offer 10/28/25

Your weekly round-up of an M&A deal walkthrough, insightful market news summaries, technical quiz questions, and various internships, events, and diversity programs. A key resource to best prepare yourself for finance recruiting. If someone sent you the newsletter subscribe below!

CAREER OPPORTUNITIES

RecruitU Partner Opportunities

RecruitU partners are companies that have recruiters actively using RecruitU to find students for their full-time and internship roles. So if you’re signed up, you have direct visibility with these companies.

Class of 2026 Finance and Consulting Opportunities

Class of 2027 Finance Opportunities

Piper Sandler 2026 Summer Intern Program – Equities Trading Technology Link

Houlihan Lokey 2026 Investment Banking Summer Financial Analyst (Class of 2027) - Multiple Roles and Locations Link

Baird Internship – Private Wealth Management (Dayton, OH Summer 2026) Link

CIBC 2026 Summer Intern - Multiple Roles and Locations Link

Wells Fargo 2026 Summer Internship, Early Careers - Investment Banking (Energy & Power) Link

Baird Internship – Private Wealth Management - Multiple Roles and Locations Link

RBC Capital Markets 2026 Wealth Management, Summer Equity Analyst Link

Citi U.S. Personal Banking Summer Analyst, Charlotte, NC - USA 2026 Link

KeyBank 2026 Summer Analytics and Quantitative Modeling Internship - Cleveland Link

Class of 2027 Consulting Opportunities

Protiviti Dallas Technology Consulting Intern - 2026 Link

To see c/o 2027 opportunities, click here: Class of 2027 Application Tracker

Class of 2028 Finance and Consulting Opportunities

TECHNICAL QUESTION OF THE WEEK:

Could you ever end up with negative shareholders’ equity? |

MARKET NEWS

US Companies Announce $80B in Deals as Trump-Era Policies Ignite M&A Revival

In a 24-hour span, U.S. companies struck over $80 billion in merger deals, marking a sharp revival in M&A activity fueled by the Trump administration’s favorable stance on consolidation and easing antitrust scrutiny. Key announcements included the $63 billion merger between American Water Works and Essential Utilities, and Huntington Bancshares’ $7.4 billion acquisition of Cadence Bank, creating a $276 billion regional banking entity. Novartis also agreed to acquire Avidity Bioscience for $11 billion. Dealmakers cite falling interest rates, improved tariff clarity, and strong capital access as drivers, with 2025 now on track for a record year in megadeals, featuring over 50 transactions exceeding $10 billion.

Source: Financial Times

JPMorgan Rolls Out AI Chatbot to Help Staff Draft Performance Reviews

JPMorgan Chase has introduced an internal AI tool based on its proprietary large language model to assist employees in drafting year-end performance reviews. Known as LLM Suite, the system allows users to generate review content from custom prompts, aiming to streamline what is typically a time-consuming corporate task. While the tool offers efficiency—similar tools reportedly cut writing time by 40%—employees remain fully responsible for the final submissions, which must not be used for salary decisions. The rollout is part of JPMorgan’s broader AI push, with the bank having onboarded 200,000 users within eight months and allocating $18 billion to technology investments in 2025.

Source: Financial Times

M&A DEAL OVERVIEW

Nelson Peltz and General Catalyst Launch $7B Takeover Bid for Janus Henderson

Nelson Peltz’s Trian Fund Management and General Catalyst have jointly offered $46 per share in cash to acquire Janus Henderson, valuing the U.S. asset manager at $7 billion. The proposed deal represents a 56% premium to the company’s April 2025 trading levels and aims to "de-risk" a business seen as highly vulnerable to market and geopolitical volatility. Trian and related parties already own about one-fifth of Janus Henderson’s shares, and the bidders argue the company would be better positioned for long-term growth as a private firm, free from the structural constraints of public markets. Janus Henderson, which manages $457 billion in assets, has recently seen inflows into its active ETFs and improvements in performance following years of struggle post-merger. The board is forming a special committee to evaluate the bid, though no deal is guaranteed.

Source: Financial Times

LAST WEEK TECHNICAL QUESTION OF THE WEEK ANSWER:

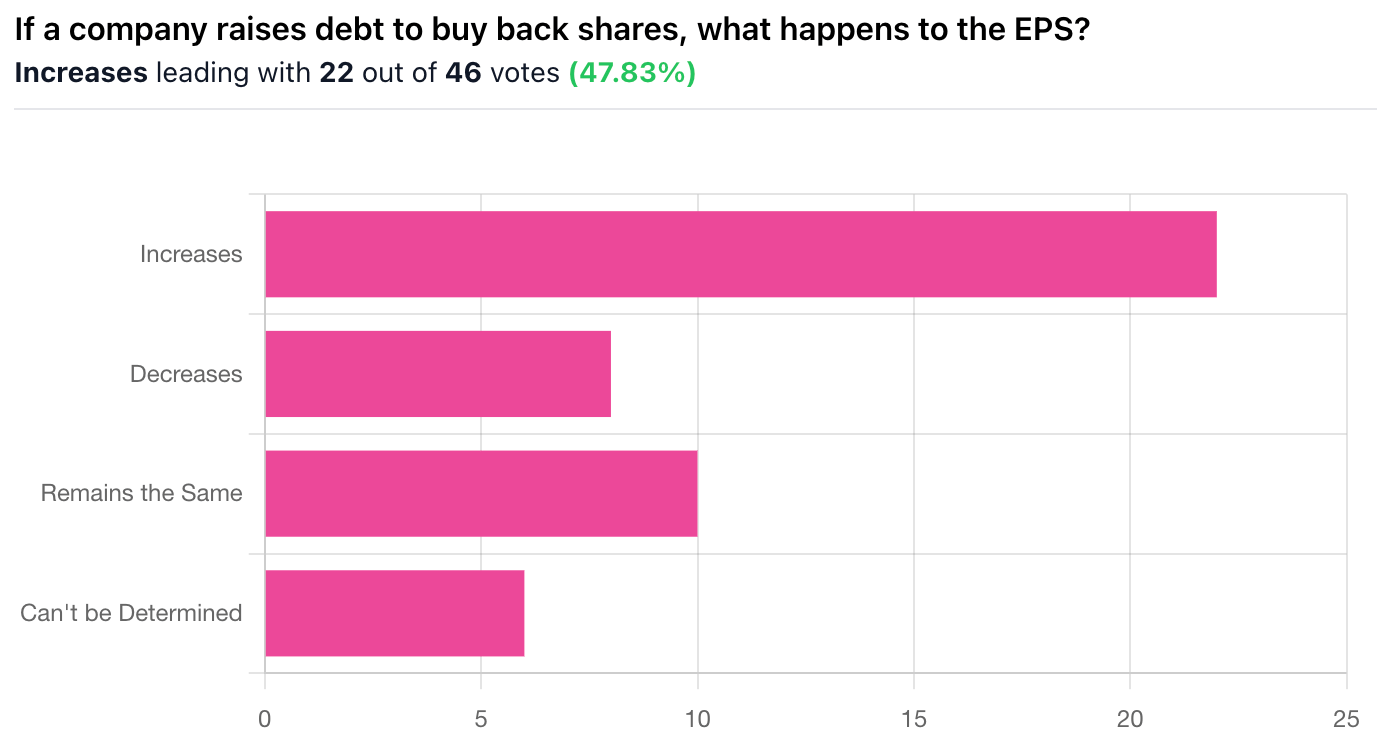

Correct Answer: D, Can't be Determined — If a company raises debt to buy back shares, what happens to the EPS?

Explanation: It can’t be determined without more information, because the effect on EPS depends on how the interest expense from the new debt compares to the reduction in shares outstanding—if interest costs are low relative to the earnings saved per share, EPS may rise; if they’re high, EPS may fall.