- First Step to Final Offer

- Posts

- First Step to Final Offer 1/6/26

First Step to Final Offer 1/6/26

Your weekly round-up of an M&A deal walkthrough, insightful market news summaries, technical quiz questions, and various internships, events, and diversity programs. A key resource to best prepare yourself for finance recruiting. If someone sent you the newsletter subscribe below!

CAREER OPPORTUNITIES

Class of 2028 Finance Opportunities

MUFG 2027 Summer Intern Program - Multiple Roles and Locations Link

Greenhill & Co. 2027 Restructuring Summer Analyst - New York Link

PSP Investments Intern, Credit Investments (June - August 2027) Link

Tidal Partners 2027 Summer Analyst Link

Scotiabank 2027 Investment Banking Summer Analyst - Multiple Roles and Locations Link

Barclays Public Finance Analyst Summer Internship Program 2027 San Francisco Link

Evercore 2027 Summer Analyst Program - Multiple Roles and Locations Link

Global Atlantic Financial Group 2027 Summer Analyst Program Link

LLR Partners Summer 2027 Investment Team Analyst Link

Kohlberg Kravis & Roberts & Co. 2027 Summer Analyst Program Link

Blackstone 2027 Blackstone Summer Analyst - Multiple Roles and Locations Link

Bain Capital 2027 Summer Analyst - Multiple Roles and Locations Link

Ares Management 2027 Summer Intern Link

Wells Fargo 2027 Summer Internship - Multiple Roles and Locations Link

Piper Sandler Campus Recruiting – 2027 Investment Banking Summer Analyst - Multiple Roles and Locations Link

Nomura Securities International 2027 Investment Banking Summer Analyst Program - Multiple Roles and Locations Link

CIBC 2027 Investment Banking Summer Analyst - Multiple Roles and Locations Link

SMBC 2027 Summer Intern Program - Multiple Roles and Locations Link

Ducera Partners 2027 Investment Banking Summer Analyst - Multiple Roles and Locations Link

Brown Gibbons Lang & Company 2027 Investment Banking Summer Analyst Link

PJT Partners 2027 Summer Analyst - Multiple Roles and Locations Link

Societe Generale Americas 2027 Summer Analyst Program - Multiple Roles Link

UBS 2027 Summer Internship - Multiple Roles and Locations Link

Morgan Stanley 2027 Summer Analyst Program - Multiple Roles and Locations Link

Goldman Sachs 2027 Summer Analyst - Multiple Roles and Locations Link

To see c/o 2028 opportunities, click here: Class of 2028 Application Tracker

Class of 2027 Finance and Consulting Opportunities

Deutsche Bank Internship Program – Investment Bank & Capital Markets: Investment Bank Coverage – San Francisco 2026 Link

Lazard 2026 Summer Internship - Client Services Analyst - Lazard Wealth Link

JPMorgan Chase & Co. 2026 Global Private Bank Advisor Program (Summer Analyst) - US Private Bank Link

Goldman Sachs 2026 | Americas | New York | Asset Management, Quantitative Investing (Wealth Investment Solutions) | Summer Analyst Link

Scotiabank 2026 Corporate Banking Internship Media & Telcom, NYC Link

KeyBank 2026 KeyBank Summer Internship - Structured Finance - Superior, CO Link

KeyBank 2026 Equity Research Summer Analyst New York Link

To see c/o 2027 opportunities, click here: Class of 2027 Application Tracker

Class of 2026 Finance and Consulting Opportunities

Houlihan Lokey 2026 Financial Analyst (Class of 2026) - Multiple Roles and Locations Link

Nomura Securities International 2026 Global Markets Full-Time Analyst Program – Structured Funding Trading Link

Piper Sandler Public Finance Investment Banking Intern - Hospitality Link

Piper Sandler Public Finance Investment Banking Analyst - Healthcare Link

Scotiabank 2026 Investment Banking Analyst Energy, Houston Link

TECHNICAL QUESTION OF THE WEEK:

In an M&A deal, what is typically the most desirable way to pay for the deal? |

MARKET NEWS

Private Equity Firms Turn to Continuation Vehicles Amid Tough Exit Conditions

Private equity firms sold assets to themselves at a record pace in 2025, with continuation vehicles accounting for roughly a fifth of all PE sales, up from 12–13% in 2024. These structures allow firms to transfer assets from older funds to new ones they also manage—helping them return capital to investors while holding onto high-performing companies in a difficult exit environment. Though pitched as win-win solutions, they’ve raised conflict-of-interest concerns among limited partners and institutional investors, especially when the same firm is on both sides of the deal. Some transactions, like Energy & Minerals Group’s attempted sale of Ascent Resources, have even prompted legal challenges from investors over valuation fairness.

Source: Financial Times

AI-Driven Demand Powers $70 Billion in Data Center M&A Activity in 2025

The surge in artificial intelligence investment has fueled over $70 billion in data center M&A talks throughout 2025, as global tech giants and infrastructure investors race to secure capacity for AI workloads. Major deals include SoftBank’s $4 billion acquisition of DigitalBridge, Google’s $4.75 billion purchase of Intersect Power, and BlackRock-led GIP’s $40 billion deal for Aligned Data Centers. Activity spanned Asia, Europe, and North America, with buyers targeting both traditional hyperscale facilities and high-performance computing infrastructure to meet the rising power demands of generative AI and cloud expansion.

Source: Bloomberg

M&A DEAL OVERVIEW

Citi Gets Internal Green Light to Sell Russian Unit AO Citibank to Renaissance Capital

Citigroup has received internal approvals to proceed with the sale of AO Citibank, its remaining operations in Russia, to Renaissance Capital. The deal is expected to be signed and closed in the first half of 2026, pending regulatory approvals. The transaction will trigger a pre-tax loss in Q4 2025 due to currency translation adjustment (CTA) losses, though the cumulative impact will be capital neutral to Citi’s CET1 ratio. The sale is expected to benefit Citi’s capital position over time by removing associated risk-weighted assets.

Source: Citi Group

LAST WEEK TECHNICAL QUESTION OF THE WEEK ANSWER:

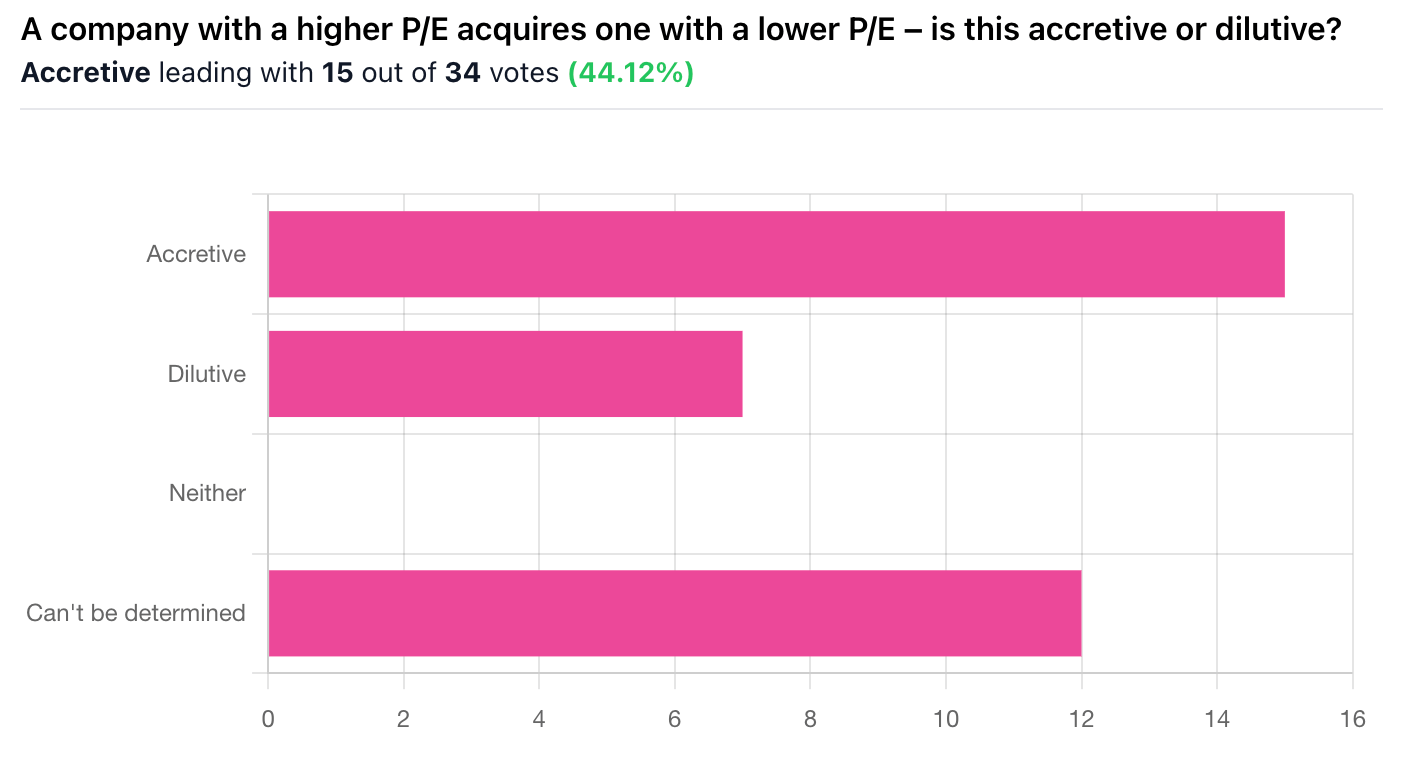

Correct Answer: D, Can't be determined. — A company with a higher P/E acquires one with a lower P/E – is this accretive or dilutive?

Explanation: It can’t be determined based on P/E ratios alone because accretion or dilution depends on how the deal is financed, the relative earnings of the two companies, and any changes to share count, interest expense, or synergies. While a higher P/E acquirer buying a lower P/E target is often accretive in an all-stock deal, this is not guaranteed—cash or debt financing, integration costs, or differences in growth and risk profiles can change the outcome. Without knowing the deal structure and earnings impact, you cannot definitively say whether the transaction is accretive or dilutive.