- First Step to Final Offer

- Posts

- First Step to Final Offer 1/27/26

First Step to Final Offer 1/27/26

Your weekly round-up of an M&A deal walkthrough, insightful market news summaries, technical quiz questions, and various internships, events, and diversity programs. A key resource to best prepare yourself for finance recruiting. If someone sent you the newsletter subscribe below!

CAREER OPPORTUNITIES

Class of 2028 Finance Opportunities

Baird Internship – Business Owner Solutions Investment Banking (Louisville, KY Summer 2027) Link

Citi US, 2027 Summer Analyst - Multiple Roles and Locations Link

Goldman Sachs 2027 | Americas | Dallas | Summer Analyst - Multiple Roles Link

JPMorgan Chase & Co. 2027 Summer Analyst Program - Multiple Roles and Locations Link

Jefferies 2027 Investment Banking Summer Analyst Program – New York, M&A Advisory Link

Houlihan Lokey Summer 2027 Financial Analyst (Class of 2028) - Transaction Advisory Services - Digital Value Creation - Multiple Locations Link

Blackstone 2027 Summer Analyst - Multiple Roles and Locations Link

Rockefeller Capital Management 2027 Summer Analyst - Investment Banking Link

AQ Technology Partners Summer Analyst: Investment Banking (Software M&A) | Summer 2027 Link

Bracebridge Capital Summer 2027 Investment Analyst Link

MTS Health Partners 2027 Summer Analyst, Investment Banking Link

To see c/o 2028 opportunities, click here: Class of 2028 Application Tracker

Class of 2027 Finance and Consulting Opportunities

Verition Fund Management 2026 Summer Internship - Investment (Houston) Link

Societe Generale Americas Internship - Credit & Structured Finance, Market Risk Link

Baird Internship – Private Wealth Management (Rockford, IL Summer 2026) Link

Citi Markets - Commodities, Summer Analyst, Houston - US, 2026 Link

Deloitte Consulting LLP - Government & Public Services - Summer Scholar - Business Analytics Link

Goldman Sachs 2026 | Americas | New York City Area | Investment Banking | Seasonal/OffCycle Internship Link

JPMorgan Chase & Co. 2026 Latin America Debt Capital Markets Summer Analyst Program Link

Houlihan Lokey 2026 Summer Financial Analyst (Class of 2027), Corporate Valuation Advisory Services, Complex Securities - Multiple Locations Link

To see c/o 2027 opportunities, click here: Class of 2027 Application Tracker

Class of 2026 Finance and Consulting Opportunities

TECHNICAL QUESTION OF THE WEEK:

In the current interest rate environment, what would be the most ideal capital structure for a LBO deal? |

MARKET NEWS

Fed Pause Nudges Bond Investors Toward Longer-Term Bets Despite Caution

With the Federal Reserve expected to hold interest rates steady, bond investors are gradually re-entering riskier territory—particularly by extending duration to lock in higher long-term yields. While rate futures now price in fewer than two Fed cuts for 2026, investors remain cautious amid tight U.S. credit valuations and global geopolitical uncertainty. Recent surveys show growing long positions in long-duration Treasuries, but portfolio managers warn against overly aggressive moves, citing stretched valuations and limited fiscal headroom for further stimulus.

Source: Reuters

Bridgewater Warns AI Spending Boom Could Trigger Economic Overheating

Bridgewater’s co-CIOs say corporate investment in AI is accelerating so rapidly that it could reshape the global economy, driving up inflation and creating conditions ripe for a market bubble. In a client note, they warned that competitive pressures are forcing companies to ramp up AI capital spending to avoid falling behind—particularly in areas like chips and data infrastructure. While this surge has lifted equity markets, they caution that "easy policy" could further fuel speculative activity and cyclical overheating in both investment and dealmaking.

Source: Reuters

M&A DEAL OVERVIEW

Blackstone Nets $400 Million Gain From Marathon Sale to CVC

Blackstone has made over three times its initial investment, pocketing more than $400 million from the sale of its stake in Marathon Asset Management to CVC Capital Partners in a $1.2 billion deal. The exit included $280 million in cash for Blackstone’s remaining interest and prior capital returns over the last decade. Marathon, which Blackstone first backed in 2016, has since evolved from a hedge fund into a diversified private credit platform. The deal highlights the growing appeal of GP stake investments as private capital firms seek growth capital and succession planning options.

Source: Bloomberg

LAST WEEK TECHNICAL QUESTION OF THE WEEK ANSWER:

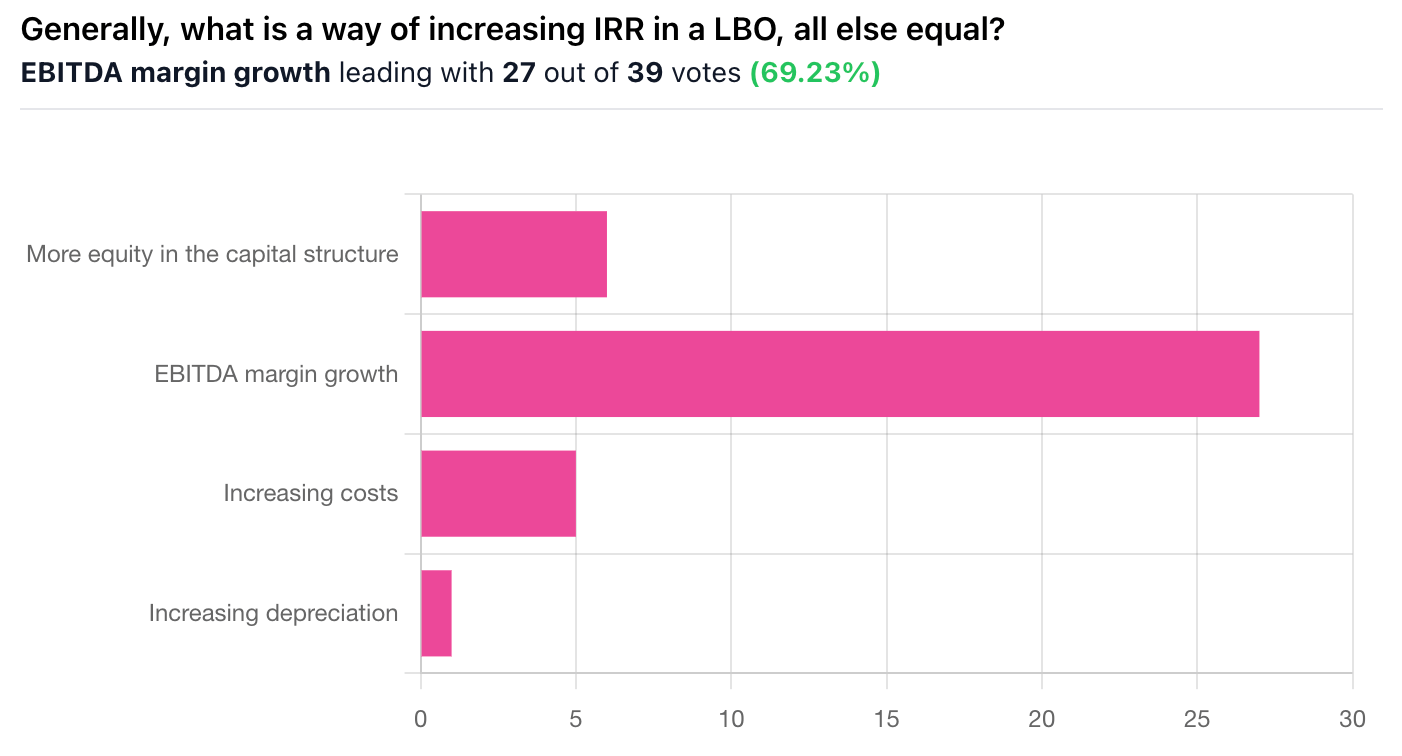

Correct Answer: B, EBITDA margin growth. — Generally, what is a way of increasing IRR in a LBO, all else equal?

Explanation: Increasing EBITDA margin growth is a powerful way to boost IRR in an LBO because it raises cash flow without requiring proportional revenue growth or additional capital investment. Higher margins increase EBITDA, which directly improves debt paydown capacity and exit valuation, amplifying equity returns through leverage. All else equal—same entry and exit multiples, timing, and capital structure—margin expansion increases free cash flow and the equity value at exit, resulting in a higher IRR.