- First Step to Final Offer

- Posts

- First Step to Final Offer 1/20/26

First Step to Final Offer 1/20/26

Your weekly round-up of an M&A deal walkthrough, insightful market news summaries, technical quiz questions, and various internships, events, and diversity programs. A key resource to best prepare yourself for finance recruiting. If someone sent you the newsletter subscribe below!

CAREER OPPORTUNITIES

Class of 2028 Finance Opportunities

Truist 2027 Truist Securities Summer Analyst Program - Multiple Roles and Locations Link

DC Advisory 2027 Summer Analyst - Multiple Roles and Locations Link

Cascadia Capital 2027 Capital Markets Summer Analyst - Multiple Roles and Locations Link

Bank of America 2027 Summer Analyst Program - Multiple Roles and Locations Link

Audax Group 2027 Private Equity Summer Analyst Link

Alpine Investors Elevation | 2027 Sourcing Summer Analyst Link

BlackRock 2027 Summer Internship Program - AMERS Link

PGIM 2027 Public Fixed Income, Summer Investment Analyst Program - Multiple Roles Link

Neuberger Berman Fixed Income 2027 Non-Investment Grade Summer Research Analyst Internship Link

To see c/o 2028 opportunities, click here: Class of 2028 Application Tracker

Class of 2027 Finance and Consulting Opportunities

CIBC 2026 Summer Intern - Multiple Roles and Locations Link

PGIM 2026 Real Estate, Summer Investment Analyst Program - Multiple Roles and Locations Link

Capstone Summer 2026 Investment Internship - Multiple Roles and Locations Link

Global Atlantic 2026 Risk Sector Analytics Intern Link

TD Cowen 2026 Summer Internship Program - Commercial Banking Link

To see c/o 2027 opportunities, click here: Class of 2027 Application Tracker

Class of 2026 Finance and Consulting Opportunities

TECHNICAL QUESTION OF THE WEEK:

Generally, what is a way of increasing IRR in a LBO, all else equal? |

MARKET NEWS

TCI Breaks Citadel’s Record With $18.9 Billion Trading Profit in 2025

Chris Hohn’s TCI Fund Management posted $18.9 billion in gains last year, surpassing Citadel’s 2022 record and John Paulson’s historic 2007 profit. The equity-focused fund benefited from soaring holdings in GE and Safran, up 86% and 42% respectively. Bridgewater ranked second with $15.6 billion, as the top 20 asset managers collectively earned $115.8 billion, dominating industry profits. Overall, the $5 trillion hedge fund industry logged 12.6% average returns, its strongest year since 2009 amid volatility from AI hype, rate uncertainty, and geopolitical shocks.

Source: Bloomberg

BlackRock’s Rick Rieder Gains Momentum in Fed Chair Race as Trump Nears Decision

BlackRock’s Rick Rieder has emerged as a leading contender for the next Federal Reserve chair, following a strong interview with President Trump. He is now part of a four-man shortlist that includes Kevin Hassett, Christopher Waller, and Kevin Warsh. Rieder is viewed as potentially easier to confirm amid heightened Senate scrutiny of Trump’s Fed nominees. As chief investment officer for global fixed income at BlackRock, Rieder has called Fed independence “critical” but also supports more innovation in central bank policy. Trump is expected to announce his final choice soon.

Source: Bloomberg

M&A DEAL OVERVIEW

Google and Stonepeak in Talks to Combine Fiber Assets in New Joint Venture

Google is in advanced discussions with Stonepeak-backed Radiate (also known as Astound) to form a joint venture that would consolidate both companies' fiber internet assets amid soaring demand for high-speed connectivity driven by AI and data-heavy applications. The proposed entity would include Google’s GFiber and Radiate’s broadband business, with Stonepeak expected to take a majority stake and contribute around $1 billion in preferred equity. The move aligns with Google’s broader strategy to deconsolidate its fiber operations, following earlier efforts to secure external investment for GFiber.

Source: Bloomberg

LAST WEEK TECHNICAL QUESTION OF THE WEEK ANSWER:

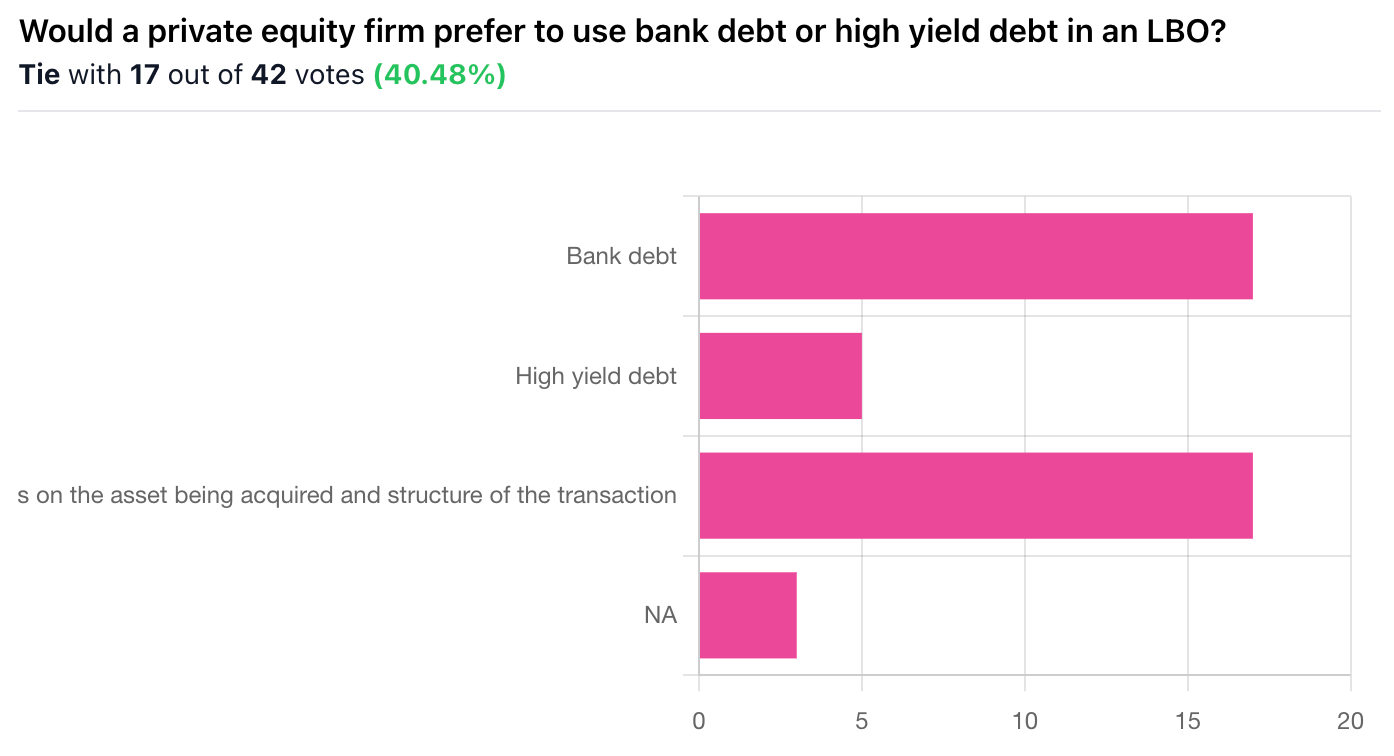

Correct Answer: C, Depends on the asset being acquired and structure of the transaction. — Would a private equity firm prefer to use bank debt or high yield debt in an LBO?

Explanation: It depends on the asset being acquired and the structure of the transaction because bank debt and high-yield debt serve different purposes in an LBO. Bank debt is cheaper and amortizing, making it preferable for stable, cash-flow-generative businesses that can support regular principal repayments, while high-yield debt carries higher interest but offers greater flexibility with looser covenants and little to no amortization, which can be useful for riskier companies, cyclical assets, or deals that require more leverage. Private equity firms often use a mix of both, optimizing the capital structure based on cash flow stability, growth prospects, and overall deal risk.