- First Step to Final Offer

- Posts

- First Step to Final Offer 1/13/26

First Step to Final Offer 1/13/26

Your weekly round-up of an M&A deal walkthrough, insightful market news summaries, technical quiz questions, and various internships, events, and diversity programs. A key resource to best prepare yourself for finance recruiting. If someone sent you the newsletter subscribe below!

CAREER OPPORTUNITIES

Class of 2028 Finance Opportunities

Macquarie 2027 Summer Internship Program - Multiple Roles and Locations Link

Aeris Partners M&A Investment Banking Summer Analyst 2027 - Multiple Roles and Locations Link

TD Cowen 2027 Summer Analyst Program - Investment Banking - Multiple Roles and Locations Link

General Atlantic 2027 Summer Analyst, Class of 2028 Link

Oak Hill Advisors 2027 Summer Intern - Multiple Roles Link

Balyasny Asset Management Catalyst Equities Associate Summer Intern Program (Summer 2027 Internship) Link

Guggenheim Securities 2027 Guggenheim Securities Investment Banking Summer Analyst - Multiple Roles and Locations Link

Cantor Fitzgerald Investment Banking Internship Summer 2027 Link

The D. E. Shaw Intern (New York) - Summer 2027 - Multiple Roles Link

Wells Fargo 2027 Summer Internship, Early Careers – CIB Commercial Real Estate - CA (California) Link

Weiss Asset Management Fundamental Analyst Internship Summer 2027 Link

Baird Internship – Equity Research Analyst (Summer 2027) Link

Blackstone 2027 Blackstone Summer Analyst - Multiple Roles Link

BMO Capital Markets Middle Markets M&A Analyst - Summer 2027 Intern - 10 Weeks - Multiple Roles and Locations Link

Citi Banking - Summer Analyst - US, 2027 Link

Deutsche Bank Internship Program – Investment Bank & Capital Markets: Investment Bank Coverage – San Francisco 2027 Link

Mizuho Bank 2027 Summer Internship Program - Multiple Roles and Locations Link

Stephens, Inc. Investment Banking Summer Analyst (Summer of 2027) Link

To see c/o 2028 opportunities, click here: Class of 2028 Application Tracker

Class of 2027 Finance and Consulting Opportunities

TD Cowen 2026 Summer Internship Program - Commercial Banking (Credit Management) Link

Baird Internship – Private Wealth Management (Summer 2026) - Multiple Roles and Locations Link

To see c/o 2027 opportunities, click here: Class of 2027 Application Tracker

Class of 2026 Finance and Consulting Opportunities

Houlihan Lokey 2026 Financial Analyst (Class of 2026) - Multiple Roles and Locations Link

Nomura Securities International 2026 Global Markets Full-Time Analyst Program – Structured Funding Trading Link

Piper Sandler Public Finance Investment Banking Analyst - Healthcare Link

Scotiabank 2026 Investment Banking Analyst Energy, Houston Link

TECHNICAL QUESTION OF THE WEEK:

Would a private equity firm prefer to use bank debt or high yield debt in an LBO? |

MARKET NEWS

Wall Street Reignites Interest in Leveraged Equity Strategies With $153 Billion in Play

Institutional investors are pouring back into leveraged equity strategies like equity extensions and portable alpha, with assets in extensions alone reaching $152.6 billion by September 2025, more than double the total from three years prior. These “hedge fund-lite” strategies—popularized through setups like 130/30 and 150/50—let managers amplify high-conviction stock picks while maintaining net market exposure. Firms such as Goldman Sachs Asset Management, Acadian, and Man Group are driving the rebound, responding to investor demand for greater flexibility amid narrow market leadership and benchmark dominance.

Source: Bloomberg

Wall Street Heads for Best Investment Banking Year Since Pandemic

US investment banks are set to report their strongest performance since 2021, with total investment banking revenues projected to hit $38 billion in 2025—a 50% increase from 2023’s $25 billion low. Quarterly revenues for the top five banks—JPMorgan, Goldman Sachs, Morgan Stanley, Bank of America, and Citigroup—are expected to reach $10 billion, up 13% from the previous year. The surge is driven by a rebound in M&A and capital markets activity, alongside growing optimism that the sector is entering a new dealmaking supercycle.

Source: Financial Times

M&A DEAL OVERVIEW

QXO Raises $3 Billion to Accelerate M&A, Backed by Apollo and Temasek

Brad Jacobs’ QXO Inc. has expanded its financing deal to $3 billion, raising an additional $1.8 billion from investors including Apollo Global Management and Temasek, more than doubling the $1.2 billion it announced earlier. The new funds will support QXO’s acquisition push, with investors committing to Series C preferred stock paying a 4.75% dividend and convertible at $23.25 per share. Other backers include PGIM and Iconiq Capital, and QXO is currently in talks with seven potential targets. The move follows its $11 billion acquisition of Beacon Roofing and reflects Jacobs’ ambition to build a $50 billion-revenue company within a decade.

Source: Bloomberg

LAST WEEK TECHNICAL QUESTION OF THE WEEK ANSWER:

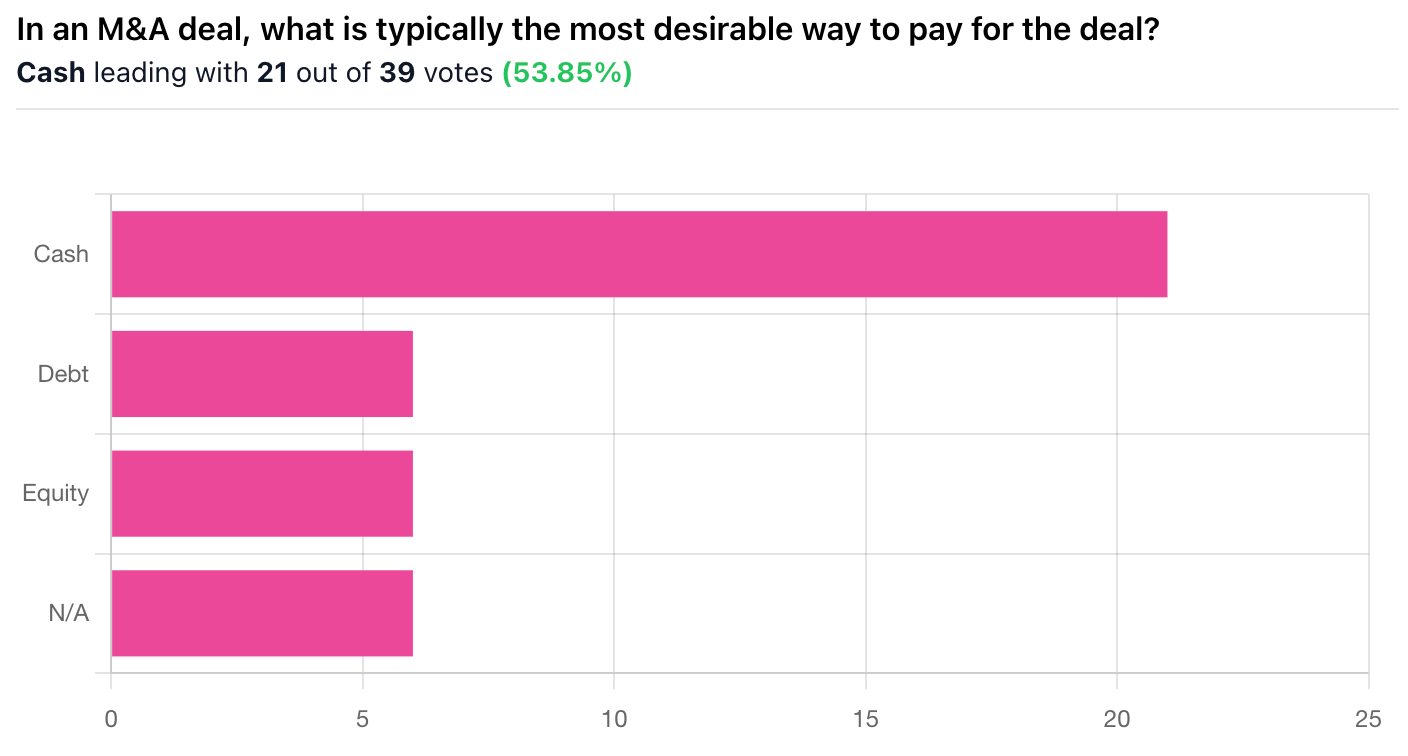

Correct Answer: A, Cash. — In an M&A deal, what is typically the most desirable way to pay for the deal?

Explanation: Cash is typically the most desirable form of payment in an M&A deal because it provides immediate, certain value to the seller and avoids future risk related to the acquirer’s stock performance. From the seller’s perspective, cash eliminates exposure to post-deal integration risk, market volatility, and dilution, making the transaction cleaner and more predictable. Cash deals also signal confidence from the acquirer in its valuation and financial strength, which is why sellers usually prefer them over stock or other consideration.